Have you filed your tax? If you haven't, perhaps you can do it now.

In recent years, Inland Revenue Board (IRB), or some people call it as tax department, is promoting e-fling (filing tax online). By using e-filing, we no longer need go to IRB office to file our tax and avoiding long queue while doing tax filing. With e-filing, we can file our tax at home.

Have you try e-filing? Perhaps, this is the guideline for you.

If you haven't register as tax payer, you need to register first.

(click

here for guideline on how to register as tax payer online)

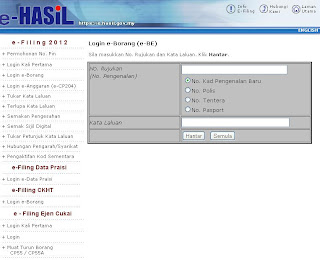

For those who have registered as tax payer and ready to file your tax, you may click the following link to log in to your e-filing account:

Then, click 'e-form login' and select 'e-BE'.

After log in, you will able to see your personal information. Check your information whether is it correct and updated

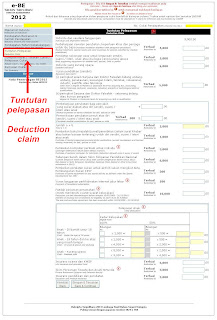

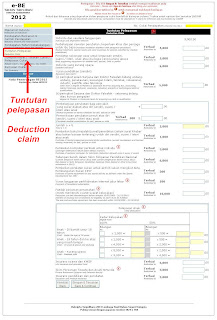

On the left hand side, besides 'particular of individual' you would see:-

- statutory income and total income

- income of preceding years not declared

- deduction claim

- rebate claim/ tax deduction/ tax relief

- tax summary

First, click on 'statutory income and total income' to enter your income.

You would see there are 4 categories of income:-

(i) employment

(ii) dividend

(iii) rents

(iv) interest discounts, royalties, premiums, pensions, anuities, other periodical payments and other gains or profits

So, you just need to enter the annual income for categories of (i), (iii) and (iv)

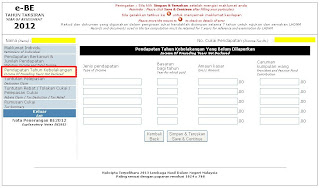

For dividend income, click the HK3.

Then you will see a form to key in your dividend income

Get your dividend vouchers beside you and key in all the dividend income according to your dividend vouchers. The format of the form above is quite similar to the dividend vouchers.

After all the dividends are entered, click '

back to income'.

After all the income for categories (i) to (iv) are completed, enter the PCB amount. PCB is tax that has been deducted from your salary monthly.

After PCB is completed, click 'save and continue'

Not only for this part, from time to time, after you entered any part, do click 'save and continue', or else your data will not be saved.

Then, if you have income preceding years that haven't been declared, you may click on

'income of preceding years not declared'.

Or else (if you don't have), proceed to

'deduction claim'.

Here, you can see the items that you can claim for deduction of taxable income. But make sure you do have the receipts as supporting documents. Or else, you may in trouble if IRB investigate on you.

After

'deduction of claim' is completed, you may proceed to

'rebate claim/ tax deduction/ tax relief'

For those who have frank dividend income, the tax can be claimed over here. After the

Form HK is filled above, the figure will automatically appear here.

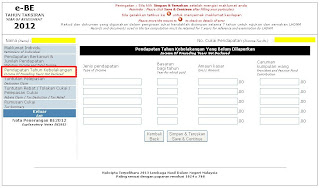

After all these have done, you may proceed to

'tax summary'. Here you can see the summary of tax and tax that you need to pay.

After everything is done, you can click

'save and continue' to submit your tax.

.jpg)