Two days ago, I have just registered myself as tax payer. As our world is now in ICT era, a lot of things can be done through online. I registered myself through online.

Want to know how to register? Here are the steps.

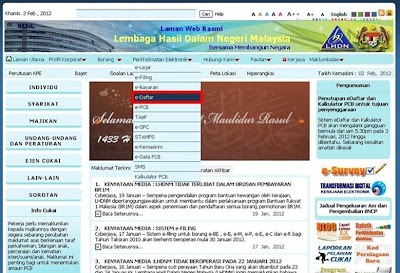

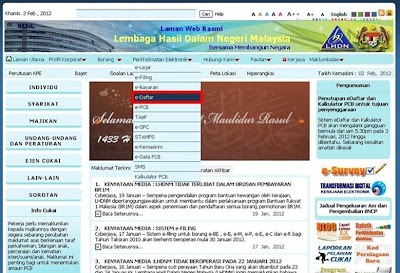

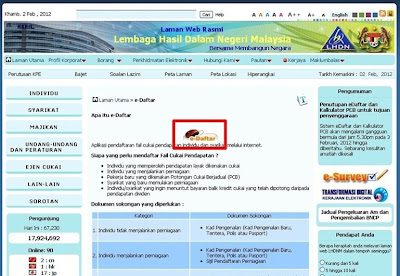

1. Go www.hasil.org.my.

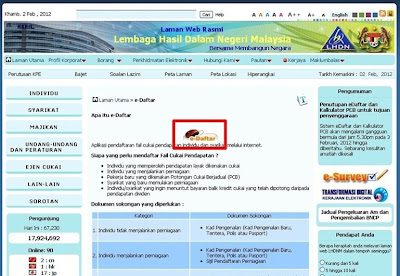

2. Click 'e-Daftar'.

3. Click another 'e-Daftar'.

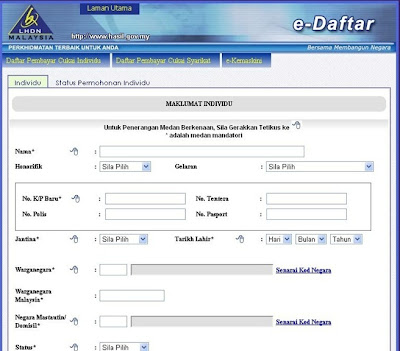

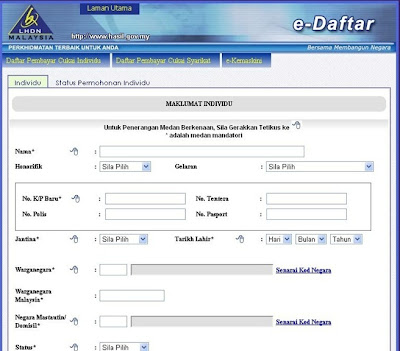

4. Click 'Borang pendaftaran online'.

5. Fill in the form.

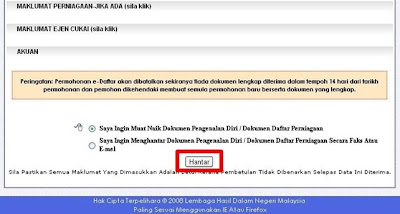

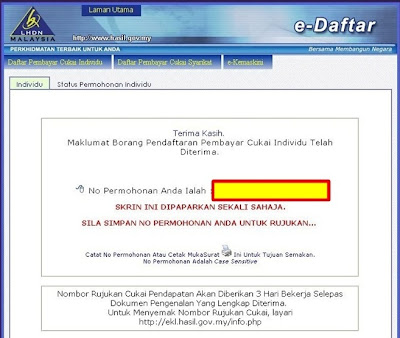

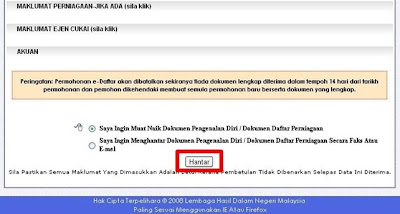

6. After completing the form, click 'Hantar'.

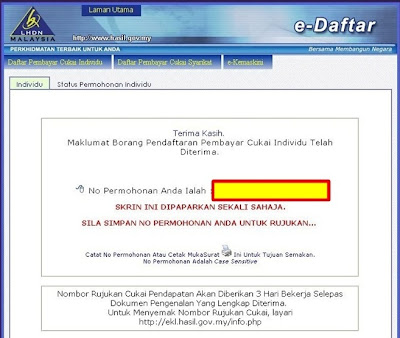

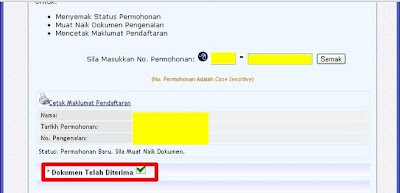

7. After you click 'Hantar', it will ask you to reconfirm your information. And after you confirm it, you will get your application number.

This number is VERY IMPORTANT! Do remember it!

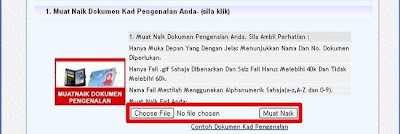

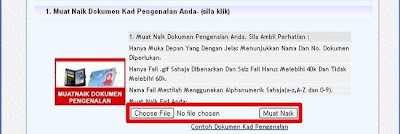

8. You are required to upload a copy of your I.C. (identity card). You may upload it right away, or you may upload it within 14 days after your application. If you want to upload it, click 'Muat Naik Disini'.

9. There are some requirements on the photo of your I.C.

(i) only front side is required in which it shows your name and I.C. number clearly

(ii) only .gif file is accepted

(iii) the file size has to be in between 40k and 60k

(iv) file name has to be in alphanumeric only

*it's also better to put the word 'For IRB use only' on the picture for the safety purpose.

When you want to upload, click on 'Choose file' to select your file and follow by clicking 'Muat naik'.

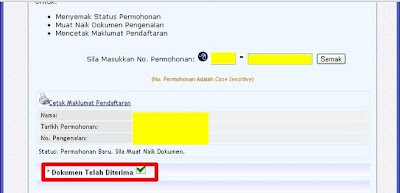

10. You will see 'Dokumen Telah Diterima' after your upload is completed.

That's all. Then you can wait for confirmation from IRB (Inland Revenue Board).

Want to know how to register? Here are the steps.

1. Go www.hasil.org.my.

2. Click 'e-Daftar'.

3. Click another 'e-Daftar'.

4. Click 'Borang pendaftaran online'.

5. Fill in the form.

6. After completing the form, click 'Hantar'.

7. After you click 'Hantar', it will ask you to reconfirm your information. And after you confirm it, you will get your application number.

This number is VERY IMPORTANT! Do remember it!

8. You are required to upload a copy of your I.C. (identity card). You may upload it right away, or you may upload it within 14 days after your application. If you want to upload it, click 'Muat Naik Disini'.

9. There are some requirements on the photo of your I.C.

(i) only front side is required in which it shows your name and I.C. number clearly

(ii) only .gif file is accepted

(iii) the file size has to be in between 40k and 60k

(iv) file name has to be in alphanumeric only

*it's also better to put the word 'For IRB use only' on the picture for the safety purpose.

When you want to upload, click on 'Choose file' to select your file and follow by clicking 'Muat naik'.

10. You will see 'Dokumen Telah Diterima' after your upload is completed.

That's all. Then you can wait for confirmation from IRB (Inland Revenue Board).

lol... haven work.. nonid pay yet.. >.<.. anyways, thanks for the info~ =D

ReplyDeleteThanks for the tutorial :) Looks easy when one cares to explain it in such a simplified manner.

ReplyDeleteMore than RM3000 only have to pay this right?

ReplyDeleteIt depends on your relief. But generally, monthly income of more than RM2,500.

DeleteLuPorTi, i got 1 question for you? You are paying income tax now? Hahaha.. Happ Chap Goh Mei to you and thanks for the sharing :D

ReplyDeleteHappy Chap Goh Meh to you too.

DeleteI am going to file my income for taxation. But, my income is still low, not subject to pay tax yet. However, I am actually investing, and the dividends I received have been deducted with the tax, I can actually claim back the tax that has been deducted from the dividends. So, I file my income to tax department to get refund from them.

thanks for the info!

ReplyDeletebut my salary... very very very low...

not subject to pay tax yet. Yet Yet yet...

^^

how long it takes to get the Cukai ref number?

ReplyDeleteI receive it within one week.

Deletehello , for the tax pay over Rm 2500 is it just basic salary?

ReplyDeletegot include other allowance like car allowance , shift allowance?

thanks for your information =)

All taxable income, including all allowance and commission received,

DeleteHi~I received my No Rujukan Cukai one week before.

ReplyDeleteBut when I go for Request Pin No., it always show "Record Not Found".

And there's a red star appear beside (Identification No.)...

One more, there's 12 digit that LHDM gave to me (except the SG/OG),

but I can only fill 11 digit in the Tax Refenrence No section...

Hi, are you applying for year assessment 2012? Have you filled tax before previously? When did you apply for the eDaftar? After apply, LHDM may take up to 2 weeks to give you the 11 digit number.

DeleteI'm not sure but I think so. This is my first time. I applied for the Tax Reference No about 10 days ago. LHDM reply me within three days with an e-mail like this:

DeleteTuan,

PEMBERITAHUAN PENDAFTARAN NOMBOR RUJUKAN CUKAI PENDAPATAN

NAMA PEMBAYAR CUKAI : (My name)

NO KP BARU / TENTERA / POLIS / PASPORT: (My IC)

Saya dengan hormatnya merujuk kepada perkara di atas.

2. Sukacita dimaklumkan nombor rujukan cukai telah didaftar seperti berikut:

No Rujukan Cukai : SG(The 12 digit number)

Cawangan : Johor Bharu

Sila gunakan nombor rujukan ini di dalam semua urusan surat-menyurat dengan pejabat ini.

3. Sekiranya sudah berkahwin, kemukakan maklumat berikut mengenai isteri/suami:

(a) Nama Penuh;

(b) Nombor Kad Pengenalan(lama dan baru)/Tentera/Polis Atau Pasport;

(c) Nombor rujukan cukai pendapatan;

(d) Tarikh perkahwinan.

4. Tuan hendaklah memaklumkan nombor rujukan cukai pendapatan yang telah didaftarkan kepada majikan

(jika berkenaan) untuk tujuan bayaran Potongan Cukai Berjadual(PCB) dan Arahan Kepada Majikan Supaya Memotong

Cukai(CP38).

Sekian,terima kasih.

'BERKHIDMAT UNTUK NEGARA'

'BERSAMA MEMBANGUN NEGARA'

Ketua Pengarah Hasil Dalam Negeri,

Lembaga Hasil Dalam Negeri.

You made the application through online?

DeleteI saw people have this problem as well. To solve this, you may email them to request for pin number through email.

Or alternatively, you may go their office to request for the e-fling pin number as well.

Yes. Through online.

DeleteOk~ I'll e-mail them right now.

(I wish there's no need to visit the office, that's why I applyied online...)

Thanks for your help~

Yea, hope you can settle it ASAP. Anything, you may ask me again here or give me an email at luporti2007@gmail.com.

Deletehow do you claim back the tax from the dividents you invested....and unit trust also?

ReplyDeletecan i have a link for me to upload my documents? Thanks

ReplyDeleteMMORPG

ReplyDeleteinstagram takipçi satın al

tiktok jeton hilesi

Tiktok jeton hilesi

Sac ekimi antalya

INSTAGRAM TAKİPÇİ SATIN AL

İNSTAGRAM TAKİPÇİ SATIN AL

metin2 pvp serverlar

Takipçi Satın Al

perde modelleri

ReplyDeletesms onay

mobil ödeme bozdurma

nft nasıl alınır

ankara evden eve nakliyat

trafik sigortası

dedektör

web sitesi kurma

Aşk Romanları

tuzla mitsubishi klima servisi

ReplyDeleteçekmeköy vestel klima servisi

kadıköy lg klima servisi

maltepe alarko carrier klima servisi

kadıköy alarko carrier klima servisi

maltepe daikin klima servisi

kartal toshiba klima servisi

üsküdar daikin klima servisi

tuzla arçelik klima servisi

Congratulations on your article, it was very helpful and successful. 3d8309ed3a7b14eafc3e93da978b718e

ReplyDeletenumara onay

website kurma

website kurma

Thank you for your explanation, very good content. 9a87ac36a55591a240a8253e9bce6883

ReplyDeletealtın dedektörü

Good content. You write beautiful things.

ReplyDeletesportsbet

hacklink

vbet

mrbahis

vbet

korsan taksi

hacklink

mrbahis

sportsbet

jordan shoes

ReplyDeletehermes bag

kawhi leonard shoes

air jordan

off white clothing

kobe byrant shoes

bape

off white clothing

GGDB

kobe 11

dijital kartvizit

ReplyDeletereferans kimliği nedir

binance referans kodu

referans kimliği nedir

bitcoin nasıl alınır

resimli magnet

714

Quick delivery when I decided to Buy instagram followers . Support team was helpful throughout the process.

ReplyDelete7J76W

off white

ReplyDeletekyrie shoes

golden goose shoes sale

bape hoodie

off white

bape hoodie

birkin bag

golden goose sneakers

bape hoodie

supreme